The City of Alexandria has mailed 2018 Vehicle Personal Property Tax bills to all vehicle owners registered in the City. Vehicle owners who do not receive a Personal Property Tax bill by September 1 should contact the Personal Property Division at vehicletax@alexandriava.gov or 703.746.3995, or the City’s Treasury Division at payments@alexandriava.gov or 703.746.3902, Option 8. Taxpayers who have had a change of address or have disposed of a vehicle and have not previously reported this change to the City should contact Personal Property so that an adjusted bill can be provided to them before the October 5 due date. Effective July 1, residential parking fees increased to $40 for the first vehicle, $50 for the second vehicle and $150 for the third and subsequent vehicles.

Personal Property Tax payments are due Friday, October 5. Any vehicle owner wishing to pay by mail should write the account number on a check or money order and mail it with the bill stub to Treasury Division, Department of Finance, City of Alexandria, P.O. Box 34899, Alexandria, VA 22334-0899. Anyone wishing to pay by another method, including eCheck, the City Hall drop box, or credit/debit card online, may visit alexandriava.gov/Payments for additional information on payment options. Returned checks, including eChecks, are subject to a $35 fee in accordance with state law.

Late payment penalties and interest will be assessed on all accounts that are not paid by the October 5 due date. The late payment penalty is ten percent of the tax due or $10, whichever is greater. Interest accrues at an annual rate of ten percent for the first year and five percent for each year thereafter.

Accounts with prior year delinquent balances may have been placed with the City’s collection agency, Nationwide Credit Corporation (NCC). The mailed bill only shows the prior year delinquent balance. As previously notified by the Department of Finance, placement of accounts with NCC results in an additional 20% collection charge on the prior year delinquent balance. Pursuant to Virginia law, the collection charge is calculated on the prior year delinquent balance at the time of payment, and therefore must be added to the Prior Year Balance shown on the bill.

Vehicle owners should contact NCC directly to determine the delinquent prior year balance plus collection charge. This amount must be paid directly to NCC. The tax bill or the amount shown on the tax bill should not be forwarded directly to NCC. Please contact NCC concerning any delinquent balance. Only after that has been paid to NCC, plus the 20 percent collection fee, can you pay your current year tax bill to the City and receive a decal. Failure to promptly resolve the delinquent prior year balance may result in collection actions and additional charges. Also, until the delinquent prior year balance is resolved, the account is blocked from paying the City directly through the various payment options listed on the tax bill. Current year 2018 taxes are still due October 5. Since payments are applied to the oldest outstanding balance, failure to pay the account in full by the due date may result in additional late penalties.

NCC works in close coordination with the City’s Department of Finance.

Nationwide Credit Corporation

5503 Cherokee Ave, Suite 100

Alexandria, VA 22312

703.776.9260

www.nccarm.com

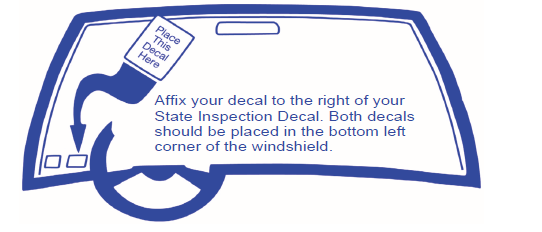

Based on a change in State regulations, please note the new location of the State safety inspection and City vehicle decals.

The City recently implemented the RADAR (Research And Discover All Registrations) program to allow City residents to identify and report vehicles regularly parked within their communities for a period of more than 30 days, that do not display a valid City vehicle decal indicating payment of personal property

taxes on that vehicle. Out-of-state vehicles not properly registered with the City may also be subject to an additional surcharge.

To report a vehicle that may not be properly registered with the City, please provide the vehicle information to the Department of Finance, Revenue Division, using Call.Click.Connect.on the City’s website. Please provide the vehicle license plate number, license plate state, vehicle make and model, and the dates and street address where the vehicle was parked. For additional information, please email the Discovery and Collections Unit at RADAR@alexandriava.gov or call 703.746.3909.

For more information on personal property taxes and related topics, please visit alexandriava.gov/CarTax.

Si necesita ayuda en Español, por favor llame al 703.746.3907.

© 1995–2022 City of Alexandria, VA and others • Privacy & Legal • FOIA Requests