News Highlights:

The City of Alexandria has made two changes that may affect residents’ 2013 personal property tax bills:

- The vehicle personal property tax rate has increased from $4.75 per $100 of assessed value to $5 per $100 of assessed value. The tax increase will help fund much needed transportation projects, such as Metro and DASH operations.

- The method for distributing personal property tax relief to qualifying vehicles has been restructured to a tiered system, based upon the vehicle’s assessed value.

More Information: Personal Property Tax Website

The City of Alexandria has made two changes that may affect residents’ 2013 personal property tax bills, which will be mailed this week and are due on October 7, 2013. These changes will not affect taxes assessed for prior years.

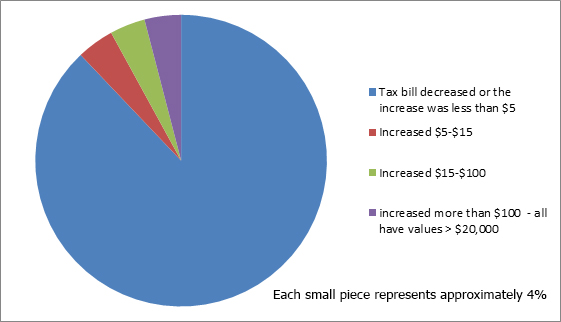

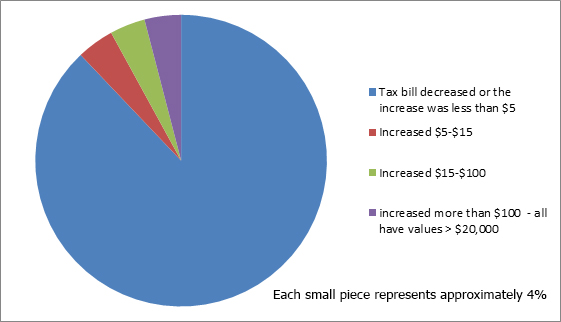

- On May 6, the City Council approved the FY 2014 budget, which went into effect July 1, 2013. The budget included an increase in the personal property tax rate from $4.75 per $100 of assessed value to $5 per $100 of assessed value. However, the restructuring of personal property tax relief may offset the resulting tax rate increase for qualifying vehicles assessed at $20,000 or less. The following chart shows how the tax rate change and restructured personal property tax relief may impact City residents.

- For 2013, the method for distributing personal property tax relief to qualifying vehicles has been restructured to a tiered system, based upon the vehicle’s assessed value.

Under the new tiered system, qualifying vehicles assessed at $1,000 or less will continue to receive 100 percent relief. However, qualifying vehicles assessed at $1,001 or more would receive the following personal property tax relief. Please note that PPTRA relief is prorated for vehicles owned for a part of the year.

- Vehicles valued between $1,001 and $20,000 will receive PPTRA relief of 61% on the total assessed value. (Maximum relief of $610)

- Vehicles valued between $20,001 and $25,000 will receive PPTRA relief of 50% on the first $20,000 of assessed value. (Maximum relief of $500)

- Vehicles valued at $25,001 and higher will receive PPTRA relief of 40% on the first $20,000 of assessed value. (Maximum relief of $400)

The tax rate increase combined with the new personal property tax relief structure is expected to have the following effects on residents’ 2013 tax bills:

- The net tax due may remain the same, or decrease slightly, for most taxpayers with a qualifying vehicle valued at $20,000 or less, compared with 2012;

- Assuming a five percent reduction in a vehicle’s assessed value, the net tax due may increase by $79.50 for a qualifying vehicle valued between $20,001 and $25,000, compared with 2012; and

- Assuming a five percent reduction in a vehicle’s assessed value, the net tax due may increase by $179.50 for a qualifying vehicle valued at more than $25,000, compared with 2012.

Vehicle assessments that increase or decrease more than the assumed five percent decrease will have a corresponding difference in the net tax due.

For more information on personal property taxes and related topics, please visit the personal property tax website at alexandriava.gov/CarTax.

Si necesita ayuda en Español, por favor llame al 703.746.3907.