[Archived] Question # 24: Can you provide a fiscal impact of fully restoring the Pre-COVID CIP Cash Capital level? Please include estimated debt service impact.

Question:

Can you provide a fiscal impact of fully restoring the Pre-COVID CIP Cash Capital level? Please include estimated debt service impact. (Mayor Wilson)

Response:

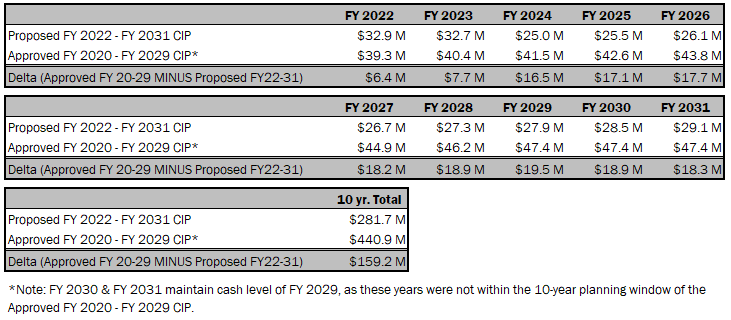

The Approved FY 2020 – FY 2029 Capital Improvement Program (CIP) represents the most recent capital investment plan with General Fund cash capital funding levels not impacted by the COVID-19 public health emergency. The Approved FY 2020 – FY 2029 CIP is also the last plan that reflects the tax rate increases for capital investment approved by City Council in FY 2017 (+2 cents) and FY 2018 (+3 cents) as direct cash transfer to the CIP (as opposed to used to service borrowing for capital projects). Table 1 compares the General Fund cash capital transfer contemplated in the Proposed FY 2022 – FY 2031 CIP as compared to the cash transfer included in the Approved FY 2020 – FY 2020 CIP.

Table 1: General Fund Cash Capital Transfer: Approved FY 2020 – FY 2029 CIP vs. Proposed FY 2022 – FY 2031 CIP

If General Fund Cash Capital were restored to the levels includes in the Approved FY 2020 – FY 2029 CIP, this would increase cash funding in the CIP by $159.2 million over the 10 year plan. This would allow the City to reduce borrowing by a corresponding amount over the FY 2022 – FY 2031 timeframe. Assuming that the increased cash capital would be used 100% to offset planned borrowing, Table 2 provides an impact on the General Fund supported debt service.

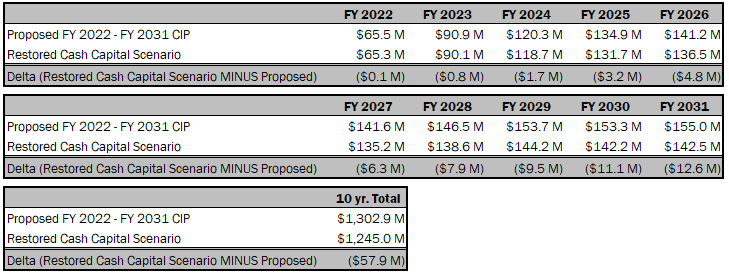

Table 2: General Fund Supported Debt Service: Proposed FY 2022 – FY 2031 CIP vs. Pre-COVID Cash Capital Restoration Scenario

Over the 10-year planning window, restoration to pre-COVID cash capital levels would result in approximately $57.9 million in debt service savings, including both reduced principal and the resulting interest payments that would be avoided. However, there would be an additional $176.4 million in debt service savings after FY 2031. While this represents a significant reduction of debt servicing costs, this scenario would result in a significant short-to-mid term increase in the total General Fund operating support of the CIP. Table 3 compares the overall General Fund support of the CIP in the Proposed FY 2022 – FY 2031 CIP and the cash capital restoration scenario contemplated. This points out that under most market scenarios the basic tenant holds true that cash is more expensive in the short term, but less expensive in the long term.

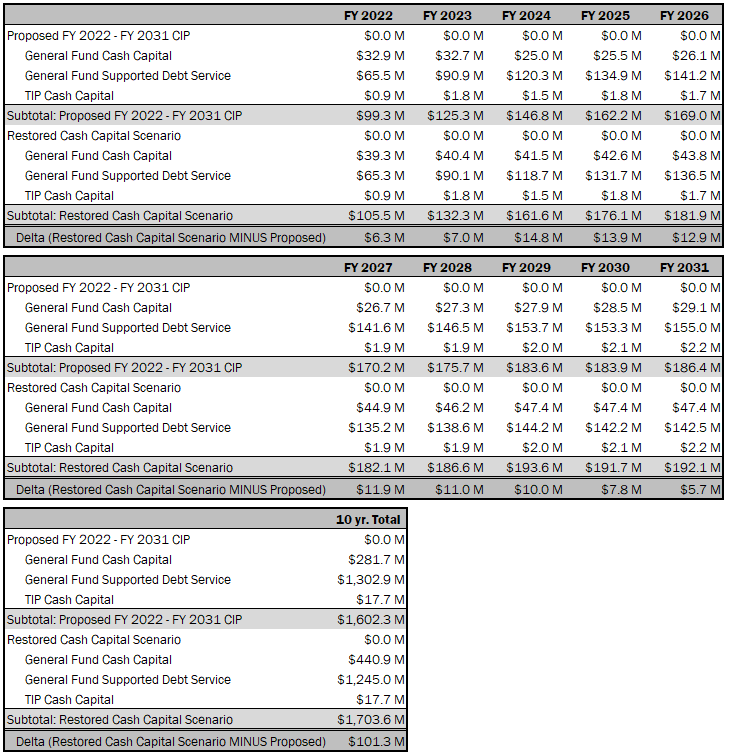

Table 3: General Fund Support of the Capital Improvement Program: Proposed FY 2022 – FY 2031 CIP vs. Pre-COVID Cash Capital Restoration Scenario

Implementing the restored cash capital scenario would result in an additional $101.3 million in General Fund operating budget transfer to the CIP over the 10 year planning window. This additional operating transfer (ranging from $6.3 million to $14.8 million) would be in addition to the increase in General Fund support of the CIP that is already contemplated in the Proposed FY 2022 – FY 2031 CIP.

In either scenario, supporting the projects contemplated for FY 2022 – FY 2031 CIP will likely require out year tax rate increases, possibly as soon as FY 2023, to offset the increased investment in the City and School’s capital needs.

The bottom line is that increased cash capital is the best solution over the long term, but more expensive in the short term. However, debt funding allows for a better “pay-as-you-use" and “intergenerational equity sharing”. A final factor are the City’s debt burden ratios which indicate that the City is approaching its debt ceiling during this 10-year CIP, which adds weigh to an increased cash capital budget position.