[Archived] Question # 10: Can you provide a list of options for providing more flexibility for relief funds (ie elderly and disabled tax relief) and other revenues collection activities such as late fees?

Question:

(10A) Can you provide a list of options for providing more flexibility for relief funds (ie elderly and disabled tax relief)? (10B) Can you provide options for providing more flexibility for other revenue collection activities such as late fees? (Mayor Wilson)

10A Response:

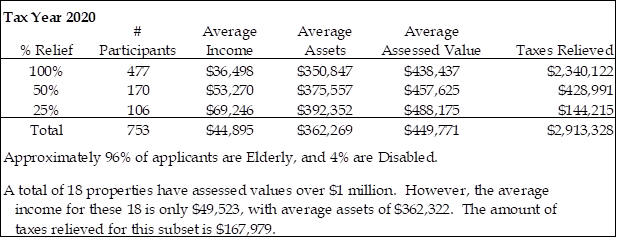

To the extent that the pandemic has reduced the 2020 income of elderly and/or permanently and totally disabled property owners, more homeowners within these groups may now qualify for income based tax relief in calendar year 2021. Property owners may also qualify to the extent the homeowners in these groups may have drawn down more assets during calendar year 2020.

Below are the existing gross income and net asset limits for the City’s Tax Relief program. Council can change these limits by ordinance. There is no maximum limit set by State law.

| Gross Income | Allowable Net Assets | Exemption Level |

| $40,000 and below | $430,000 | 100% Exemption |

| $40,001 - $55,000 | $430,000 | 50% Exemption, Deferral of balance |

| $55,001 - $72,000 | $430,000 | 25% Exemption, Deferral of balance |

| $72,001 - $100,000 | $430,000 | Up to 100% Deferral Only |

The allowable net assets of the owners exclude the value of the home and up to one acre of land. Gross income includes the income of all owners and of any relatives living in the home, except that relatives can exclude the first $10,000 of their income. Disabled owners and disabled relatives can also exclude the first $10,000 of their income.

There are two areas that may have been influenced by the pandemic during the past year. First, it is possible that more relatives returned home and resided with property owners during 2020. If so, it is possible that the additional relatives could have bumped the owners into different relief ranges, if not out of the program entirely. Current 2021 applications are just being processed so it is too early to know whether or not this is the case) Council could consider a higher exclusion for relatives - perhaps excluding the first $15,000 or $20,000 of each relative’s income instead of the first $10,000.

Also, gross household income would generally include unemployment compensation, and since more households may have unemployment income in 2020, Council could consider excluding from the 2020 gross income (used for determining 2021 Tax Relief) any unemployment benefits or COVID-19 related sources of income from the government.

Staff believes that these options are reasonably tied to the pandemic and are not expected to create a significant revenue shift, although staff does not have quantified data from which to make an accurate revenue projection as a result of such changes. Council could still enact these changes for the 2021 Tax Relief program if it so desires by enacting an ordinance, preferably before May. For every 10 taxpayers added to the Tax Relief program at 100% relief, General Fund revenue is reduced by roughly $60,000.

This program is governed by Title 3, Chapter 2, Article L of the Code of the City of Alexandria, and by Section 58.1-3212 of the Code of Virginia. The State enabling legislation defines income as including the income of relatives living within the home. However, the statute goes on to say that “Nothing in this section shall be construed or interpreted as to preclude or prohibit the governing body of a county, city or town from excluding certain sources of income, or a portion of the same, for purposes of its annual income limitation or excluding certain assets, or a portion of the same, for purposes of its net financial worth limitation.”

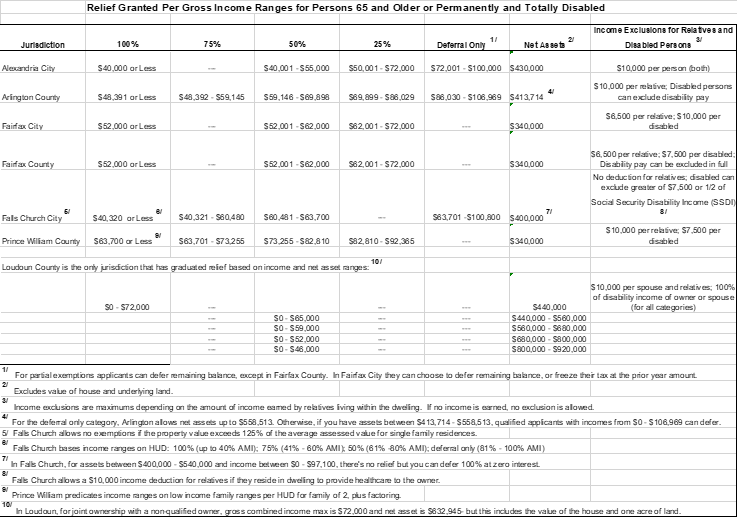

Below is a comparison of Tax Relief limits in other Northern Virginia localities which shows Alexandria income eligibility thresholds are generally less than other Northern Virginia comparables, but the City’s net asset thresholds are generally higher:

10B Response:

Late payment penalties and interest for Real Estate Taxes, Car Taxes, Business Personal Property Taxes and Business, Professional and Occupational License (BPOL) Taxes are estimated to total approximately $2.6 million annually in both the FY 2021 and FY 2022 budgets (flat). Of the FY 2021 amount, approximately half has been collected to date, leaving approximately $1.3 million to be collected during the remaining three months. However, collections are running behind compared to this time last year in part due to the previous extension in the due date for Personal Property and from the extended waivers associated with Real Estate; and, in part due to the disrupted economy associated with the pandemic. Based on this, a revised estimate of the amount expected to be collected from late payment penalties and interest during the remainder of FY 2021 is closer to $717,000 at this time. This estimate excludes interest on BPOL payments as that cannot be eliminated per state law. Staff also anticipates collecting approximately $51,000 in administrative collection fees during the remainder of the year.

Should Council desire to take action to eliminate collection fees and outstanding penalties and interest for delinquent taxpayers for Tax Year 2020 (i.e., the year most economically impacted by COVID-19), an ordinance amendment could be adopted abating these on unpaid accounts. If penalties, interest and administrative collection charges were abated by ordinance amendment on the above referenced tax categories between, for example, from mid-April through June 30, 2021, the approximate revenue loss in FY 2021 is estimated at $768,000. If such an abatement excluded the Real Estate Tax category, the estimated loss would be approximately $420,000. It is recommended that if such any such action were taken that it be conditioned upon the payment of the underlying tax in full by June 30th. Staff recommends limiting any such abatement to FY 2021. However, if extended past July 1, 2021, the anticipated additional loss in FY 2022 would be approximately $140,000.

Alternatively, Council could also choose, for example, to simply cut the late payment penalty, interest, and collection fee in half during this period (from 10 percent to 5 percent; and from $30 to $15). The potential revenue reduction in FY 2021 would be approximately $384,000. Again, staff recommends that any such action be conditioned upon the payment of the underlying tax in full by June 30th.

Penalties on the Meals Tax and Transient Lodging Tax have not been factored into this analysis since they are Trustee Taxes paid by the consumer not by the business.

Amnesty programs often increase the penalties at the end of the forgiveness period where penalties and interest are reduced or eliminated for a specified period of time. The only tax category that has this type of flexibility based on current law is Personal Property. In this instance, for example, Virginia law would allow Council to increase the late payment penalty on remaining Personal Property Tax delinquencies to 25 percent at the end of the amnesty period in lieu of the current 10 percent penalty. Council could also choose to simply restore penalties and interest to their normal level at the end of the abatement period.

It is important to recognize that under an abatement or amnesty program, delinquent taxpayers receive a preferential benefit in that their late charges are reduced or eliminated whereas taxpayers who previously paid late subject to and paid the late charges. Those previous payments cannot be refunded as they were properly collected under the law existing at the time of payment. Under State law, there is no statutory authority that would allow for a future discount to taxpayers who paid Tax Year 2020 on time or to offset penalties and interest already paid by taxpayers.

Finally, it should be noted that the Department of Finance has already taken a very soft approach to collections since the start of the pandemic. Extended payment plans are maximized, enforced collections such as bank liens were halted, and delinquent Car Tax accounts were recalled from the department’s third-party collection company to help delinquent taxpayers avoid the additional 20 percent collection charge of the collection agency. Similarly, delinquent Real Estate Taxes were not placed with the department’s collection agency as planned for the same reason. While the department is continuing to mail out delinquent bills, this soft approach is not without impact as collections are lagging. Staff continues to monitor collections as part of the on-going budget process. At this time, staff plans to resume normal tax collection operations in FY 2022.

Printable Version