[Archived] Question #36: How much funding could be generated by the hotel tax if it were increased at various levels?

Question:

How much funding could be generated by the hotel tax if it were increased at various levels?

Response:

The following is an update of FY 2018 budget question #67: What is the City's transient occupancy tax rate? What is the rate in Arlington and Fairfax Counties? Does the City have the authority to increase the rate and if so, what is the cap? How much revenue would a 1.0% increase produce?

The City’s transient occupancy tax rate is 6.5% of the room charge plus $1 per room per night. The regional transient occupancy tax for the Northern Virginia Transportation Authority (NVTA) is 2.0% of the room charge. The combined transient occupancy tax is 8.5% of the room charge plus $1 per room per night in addition to sales tax. The total sales tax (which applies to hotel room sales) in the City is 6.0% which includes State sales tax of 4.3%, the City sales tax of 1.0% and the regional sales tax for NVTA of 0.7%. In total, the cumulative tax rates equal 14.5% plus $1 per night.

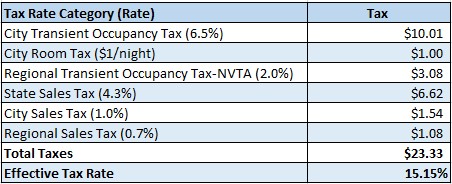

The table below illustrates the total taxes assessed on the FY 2017 average daily room rate of $154.00

The combined transient occupancy and sales tax in Arlington County is 13.25% and 12.0% in Fairfax County. This puts Alexandria’s (15.15% on the average $154 room) 1.9% - 3.15% higher than our Northern Virginia competitors. With an already higher rate, City Staff have concerns about raising the City's rate higher without a detailed study of the impact a higher rate could have on hotel business.

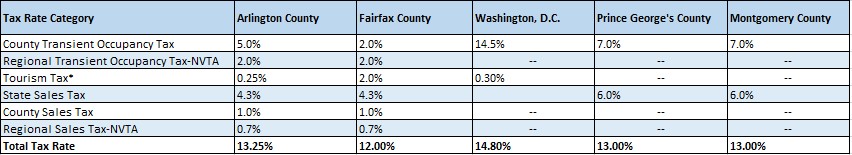

The table below provides a breakdown of the combined transient occupancy and sales tax in Arlington, Fairfax County, the District of Columbia, Prince George’s County, and Montgomery County.

*Used exclusively for travel and/or tourism.

Note: The City of Alexandria is the only local jurisdiction with a per room/night charge

The City does have the authority under Virginia code sections 58.1-3840 and 15.2-1104 to increase the tax rate to any rate, unless specifically prohibited by law, therefore there is no tax rate cap on transient occupancy tax. In FY 2017, the City generated $12.4 million in transient occupancy taxes. Of this amount, $11.3 million was derived from the base tax rate on room charge and $1.1 million was derived from the room tax. Based on the FY 2019 projected revenue of $11.8 million from the base tax rate, the City would generate $1.8 million in additional transient occupancy tax if the rate increased by 1.0%. With the City combined transient and sales tax rate of 14.5% plus $1 per night already being the highest rate in Northern Virginia, caution should be exercised and further research on hotel rate competition be undertaken before the City considers raising this tax rate again.