[Archived] Question #20: Please provide the estimated revenue impacts and expenditure reductions from elimination of the annual vehicle personal property tax decal.

Question:

Can you provide the estimated revenue impacts and expenditure reductions from

elimination of the annual vehicle personal property tax decal?

Response:

Given the fixed importance of the personal property tax collections to the City and the changing technologies now available for vehicle registration enforcement, staff has concluded that the City staff may be close to the cusp of considering recommending elimination of the vehicle tax decal starting in FY 2020 or soon thereafter. This response is lengthy, but staff thought it useful to provide an extensive response.

Summary

Pursuant to Virginia Code Section 46.2-752(G), localities can eliminate the tax decal display requirements for vehicles, and yet still charge the same local registration fee. Given the annual billing cycle and associated programming requirements, the elimination of vehicle decals in the City of Alexandria could be implemented no earlier than FY 2020, should City Council so direct. Eliminating the decal is a question of delinquent tax enforcement and discovery efforts of potential tax evaders. Of the two, discovery is the larger concern.

When vehicles are moved into the City of Alexandria, they are required to register with the City and display a vehicle decal. Failure to display a decal subjects the owner to tickets issued by the Alexandria City Police Department (ACPD). The failure to display a decal also provides citizens with a point of reference to submit complaints to City staff, identifying vehicles that normally park at specific locations but appear to be evading the City’s personal property tax. Elimination of the decal removes the most immediate, visible sign that a car may be evading local taxation.

There is no way to conclusively quantify the potential amount of revenue that goes undetected due to the evasion of registration requirements. Staff can report on efforts it has taken, but it is always possible this represents the “tip of the iceberg,” with only inferences drawn about the remaining undiscovered potential. While staff has made $104,300 discovery assessments to date, it is feasible that this could grow in the future to as much as $315,000, and possibly much higher, based on a comparative analysis of similar programs in other jurisdictions. Elimination of the decal would complicate the discovery effort. However, while the decal is one tool to assist in

discovery assessments, other options exist to help facilitate the discovery program should the decal be eliminated. Aside from vehicle discovery issues, the immediate net loss from eliminating decals would be approximately $156,000, principally from the elimination of “No Decal” citations. Staff also anticipates improved customer service associated with the elimination of decals.

Since FY 2020 is the earliest any change could be implemented, no decision by Council is needed at this time. Staff will continue to research this and develop a recommendation to bring forward to Council later this year.

Discovery Analysis

In FY 2018, the Department of Finance undertook measures to help bolster discovery efforts to identify vehicles that should be added to City tax rolls. Prior to this, the main tools included reliance on DMV computer-matching, and site observations by Parking Enforcement Officers (PEO’s). While staff continues to utilize these tools, additional research is now conducted via the RADAR program (Research And Discover All Registrations). This effort relies on added research by Revenue Division employees, along with complaints received from the public.

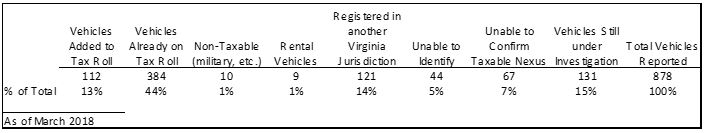

Through three-quarters of FY 2018, staff has received 878 reports of potential vehicle tax evaders through the RADAR program. Of these, 13% or 112 vehicles have been added to the tax roll, generating approximately $104,300 in additional tax levy. While the percentage may seem low, it is very consistent with a similar program (TARGET) that has been conducted in Fairfax County for the past 20 years.

Rather than repeated site observations, the RADAR program seeks to cast a wide net trying to identify license plate information and research this against online databases to establish taxable nexus with the City. For example, upon identifying a vehicle year, make, model, and owner, staff then tries to determine whether or not indications support that the vehicle is normally garaged here. For example, staff has online access to the DMV, Virginia Income Tax records, and the Virginia Employment Commission. Staff also regularly confers with tax officials in other jurisdictions to validate registrations in those jurisdictions. In conjunction with these tools, staff also relies upon complaints from the public as to how regularly vehicles park in specific locations.

The available data provides an indication as to taxable nexus, and the

Department of Finance bills taxpayers accordingly. Aside from the 13%

added to the tax roll, the following provides a distribution summary of the

remaining vehicles:

Of the 878 vehicles reported to date, 55% have out-of-state license

plates. These are unaffected by the use

of a vehicle decal (i.e., a decal is not necessary to identify and research

these vehicles). Moreover, of the

$104,300 assessed to date, 88% or $91,500 comes from the out-of-state vehicles,

primarily due to the “No Plate” surcharge imposed by Title 3, Chapter 2,

Article Y of the Code of the City of Alexandria. It is anticipated that research on

out-of-state plates would continue, regardless of whether Council abolishes the

decal display requirement.

Approximately 45% of the 878 reported vehicles have Virginia license

plates, and 39 of these have been added to the tax roll, generating an

additional $12,800 in tax levy. Failure

to display a decal is a key in identifying potential tax evaders among the

Virginia license plates. However, there

are reasons other than tax evasion as to why a decal may not be displayed (such

as delinquent taxes, in which case payment is already being pursued; the

statutory grace period for new move-ins and purchases; visitors; and simple

procrastination in affixing the decal).

For example, of the 393 Virginia license plates reported for

investigation, 214 are already on our tax rolls, and another 119 are registered

in other jurisdictions (which may include recent move-ins to the City). Aside from recent move-ins, if staff can

determine the vehicle is actually normally garaged in the City, staff will work

with the other jurisdictions to adjust the tax liability, but these can be some

of the more difficult cases to substantiate.

This experience is not dissimilar from Fairfax County’s program. The County stopped researching Virginia

license plates in FY 2004, opting instead to rely wholly on its DMV matching

program. Based on FY 2002 data, the

staff report at that time found that of $5.05 million levied as result of staff

tax evasion research, $4.9 million would have been identified through the

automated matching process. Since that

time, the County’s version of the RADAR program has focused exclusively on

researching out-of-state vehicles (and the County’s decal was eliminated in FY

2007). In FY 2017, 18,236 out-of-state

vehicle complaints generated $2.5 million in additional tax levy.

Loudoun County, which is abolishing its decal as of July 1, 2018,

reports that their vehicle discovery program, Project Fairness, assessed 1,287

vehicles in FY 2016, generating $957,000 in taxes and registration fees. However, the County’s Department of

Management and Budget reports that staff is unable to determine how much of

this might have been detected via DMV data-matching. Accordingly, Loudoun

County stated that “the elimination of vehicle decals will likely entail some

revenue loss to the County, but based upon the currently available information,

DMB staff believes the likely exposure to be approximately $1 million.”

During Calendar Year 2017, Arlington County reports that their

discovery team identified 5,622 vehicles to research, assessing an astonishing

61% of the vehicles researched. This

clearly represents a percentage outlier from the other jurisdictions, and staff

will continue to explore this with Arlington County. Arlington County has in

recent decades had the most aggressive vehicle tax assessment program in

Northern Virginia. These assessments

added approximately $1.6 million in tax levy.

The Commissioner of Revenue in Arlington has a staff of six employees

dedicated to discovery. They go out to

make field observations in teams of two about three times per week.

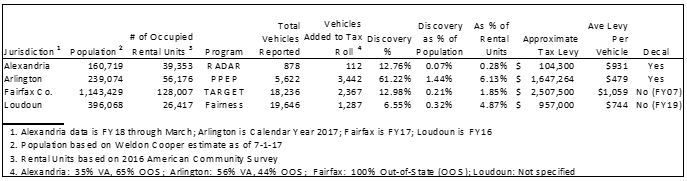

The following comparative data helps put the discovery information in context, keeping in mind that the City’s program first launched in FY 2018:

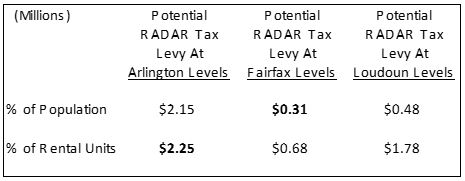

For perspective, as the program matures, if the City’s RADAR efforts eventually approach the relative levels reported by the other jurisdictions, the potential tax levy could fall in the following ranges:

This represents gross tax levy before expenditures, exonerations or

collection rate. It should also be

cautioned that these are potential ranges.

The speculative nature of this comparison assumes all things are equal,

to include staffing, support, and comparable taxpayer trends.

The existing discovery program in the Department of Finance was

absorbed among existing resources, without a staff increase. Also, Finance staff and citizen complaints

presently account for 84% of the vehicles reported in the City for research,

with about 1% from PEO staff. Comparatively, Fairfax County gets 37% of its

tips from law enforcement personnel operating daily within the County,

contributing approximately $503,000 in tax levy from Police and Sheriff vehicle

reports.

Again, the ability to add discovery vehicles to the tax roll is

directly related to casting a wide net.

Assuming the City’s percentage of discovery assessments remains constant

at around 13%, the annual number of 900 vehicles reported for research today

(about 0.7% of the City’s total vehicle base), would have to increase by almost

300% (about 2% of the total vehicle base) to reach the lower range of potential

tax levy.

To reach the high end of the potential levy range, the number of vehicles reported for research would have to grow by more than 2100% (or about 14% of the total existing vehicle base). Of course, the more tips received, the more research workload is required.

Along with staffing, there are operational enhancements that can be

pursued that could help the discovery process, particularly if decals are

abolished. Arlington and Loudoun initiatives are discussed below.

Arlington’s License Plate

Reader (LPR) Initiative:

Arlington’s Commissioner of the Revenue has long been a staunch

advocate of keeping vehicle decals because of the discovery benefit. That appears to be changing however. On April 10, 2018, the Commissioner of the

Revenue briefed the Arlington County Board on her LPR initiative, which she

plans to launch in the coming months.

With this, the Commissioner believes decals will no longer be an

important part of her discovery efforts.

The elected Arlington Treasurer already believes decals are unnecessary

from a collection standpoint, and finds that “issuing decals is far more

burdensome than collecting would be without the decal.”

Under the LPR plan, the Commissioner intends to purchase a mobile LPR

system from a company named Elsag Systems (part of Selex ES Incorporated). Elsag already provides law enforcement LPR’s

to the ACPD and to the Fairfax County Police, among others.

The system comes with two cameras mounted on both sides of a car. The Commissioner plans to download a file of

the license plate numbers that are already in her tax database. Using the cameras, her staff will drive

through parts of the County (such as parking lots of rental complexes), and

scan license plates. Any license plate

that does not match her existing tax file, will be automatically added to a

research list.

The Commissioner intends to send each list to a third-party database

vendor, LexisNexis, to obtain vehicle owner information, along with the year, make

and model, and any residence information that may help establish taxable

nexus. Her staff will then review and

further research the information from LexisNexis in order to make final tax

determinations. Certain discovery

letters are also expected to be used in this process.

The Elsag camera system comes with a one-time procurement cost of

$25,000, plus recurring annual costs of approximately $2,000. Matching with the LexisNexis database is a

batch process expected to cost approximately $1.85 per returned vehicle

information. So, information on 10,000

vehicles, would cost approximately $18,500.

A subset of these vehicles would presumably be assessed and billed for

taxes.

If the City were to undertake a similar initiative, the Department of

Finance already has a discovery contract with LexisNexis, approved as part of

the FY 2018 budget. This contract provides

unlimited vehicle look-up, but this is a manual process. Moreover, LexisNexis does not have Virginia

vehicle information. Virginia is one of

the few states that does not provide them with vehicle data. As a result, LexisNexis is only used for

out-of-state research. Should the City

pursue an LPR program, batch results could be sent to LexisNexis for

out-of-state plates, or staff could continue manual research at no additional

cost.

As for Virginia licenses identified using the LPR, staff in the

Department of Finance could also continue to manually research these using

online access to DMV, Virginia Income Tax records, the Virginia employment

commission, and contacting other jurisdictions.

However, if the volume of tips to be researched expands exponentially,

additional staff would be required. At

the existing volume, staff has over 100 plates typically in the pipeline

waiting to be researched. For

perspective, were the Department of Finance to hire two temporary employees to

supplement research efforts, the added cost would be approximately $119,000 per

year.

Under an LPR process, vehicles would be routinely researched even

without the City decal. Falls Church is

also considering implementing the same program, and currently rides a GSA

contract with Elsag.

As an aside, on November 18, 2016, in Neal v. Fairfax County Police

Department, the Fairfax County Circuit Court ruled that a vehicle license plate

number is not personal information. As

such, collection of this information via License Plate Readers is permissible

under State law. The Plaintiff in that

case currently has an appeal pending before the Virginia Supreme Court.

Loudoun County Enhancements:

Along with two additional employees added in FY 2019, the Commissioner

of the Revenue for Loudoun County is considering a range of discovery

enhancements concurrent with the elimination of decals in July. Ones that could be equally useful in the City

include the following:

1. The Commissioner plans

to begin sending letters to purchasers of real estate in the County to notify

them of personal property tax requirements.

In the City, staff also recommends that similar flyers be given to

property managers and rental agents for distribution to new tenants. The Commissioner also plans to obtain from

property owner associations lists of vehicles and the owner information where

vehicles are issued parking permits or “gate openers” for gated

communities. Existing authority is

already available under state law for tax officials to issue a summons for such

information. Under the City’s Charter

however, consideration might also be given to pursuing a legal mandate, if

permissible, to ensure distribution of the information flyer and require data-sharing

for apartment and condo parking registrations.

An ordinance requirement rather than a summons request would likely

prove more efficient. Staff will vet the

legal possibilities in this regard with the City Attorney’s Office. Virginia Code § 58.1-3901 already enables the

Department of Finance to obtain annual tenants’ lists from apartment complexes,

but this typically comes without any vehicle data. As such, the present lists are like looking

for “a needle in a haystack,” although they can provide some corroborating data

based on other vehicle reports.

2. Va. Code § 24.2-405

states that the State Board of Elections “shall furnish, at a reasonable price,

lists of registered voters” to local tax officials “for tax assessment,

collection, and enforcement purposes.”

The Loudoun Commissioner intends to obtain this information on an

on-going basis. The Department of Finance

recommends that it do likewise. Again,

this information helps build the case that a given vehicle owner is a resident

of the City.

3. The Commissioner

intends to obtain an annual list from the Virginia DMV of all vehicles with a

mailing address within Loudoun, but reportedly garaging their vehicle in

another jurisdiction. There certainly

can be valid reasons for this, but the list provides an excellent starting

point for research of potential tax evaders.

The City’s Department of Finance has already asked its programming

staff to work with the DMV to obtain such a list— at least annually, and

possibly on a quarterly basis. Finance

previously attempted a data-sharing arrangement with other Northern Virginia

localities, but the process proved too cumbersome to yield meaningful

results. The process using the state’s

central database appears more promising.

4. Loudoun is also

researching the authority to compel vehicle parking information from the

County’s public school system. Staff can

also vet this concept with the City Attorney’s Office. At the same time, staff can broach a

voluntary information-sharing process with the ACPS.

5. Finally, the Freedom of

Information statute, Va. Code § 2.2-3705.7(7) authorizes public utility

companies to release the names and service address for customers within the

City. Release of the information,

however, is at the discretion of the record custodian. The Commissioner is going to test his ability

to obtain this information for all new residents in the County. Should he fail to gain the cooperation of

utilities, he has proposed that Loudoun County support appropriate legislation

at the General Assembly making disclosure for tax investigations

mandatory. City staff can explore this

concept with local utilities, and with the City Attorney’s Office.

Finally, it should be noted that Loudoun has not previously employed

the out-of-state license plate surcharge.

The Commissioner has proposed that Loudoun adopt this charge. The City of Alexandria is already enforcing

its existing ordinance.

Both the Arlington and Loudoun initiatives have merit and could help

boost discovery efforts in the City, with or without the display of

decals. However, management of the

ensuing workload would have to be carefully monitored and staffed in order to

avoid accumulated backlog. The initial

use of additional temporary employees could help establish the proof of concept

and determine any potential return on investment.

Discovery efforts aside, it should be noted that without decals, there

clearly would be less visible indication for the public as to what vehicles may

or may not be complying with local registration requirements. This will result in some complaints from

citizens anxious to ensure everyone pays their fair share of taxes, and from

those looking for enhanced enforcement of parking complaints. Counterbalancing this would be those citizens

who would appreciate eliminating the annual task of affixing and scraping

decals from their windshield.

Decals

and Delinquent Collections

Historically, decals have been linked to delinquent tax enforcement

since failure to pay Car Taxes results in the withholding of decals, and

subjects the vehicle owner to repeated parking tickets. However, the importance of decals in this

process is no longer preeminent. Throughout the Commonwealth, the elimination of windshield decals has

been a growing phenomenon.

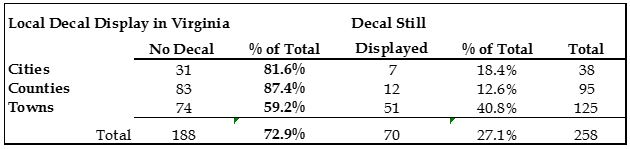

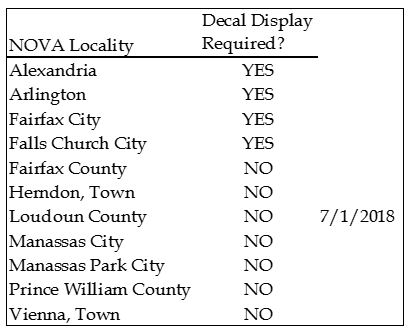

Whereas most jurisdictions used to require the display of decals, based on a recent survey almost 73% of all jurisdictions have now abolished the display requirements, while retaining the fee as a local registration requirement. Of this amount, nearly 82% of cities have abolished the requirement to display a decal:

The chart below shows that approximately 60% of Northern Virginia localities have now abolished their decal display requirements. All of Tidewater has likewise done the same, including the City of Virginia Beach. It should be noted that in comparison to jurisdictions statewide and in Northern Virginia, Alexandria has a more transient population and a bigger apartment rental share of its housing stock making personal property tax collection more challenging and enforcement more difficult.

Concern has been expressed in the past that abolishing the decal would

result in a precipitous decline in the personal property collection rate,

because decals cannot be purchased without paying the Car Tax. Yet, this has not been the general experience

in other localities. For example,

Fairfax County abolished their decal display requirement in FY 2007. Over the 10-year period from the last time

decals were required, the County’s collection rate varied by an average of no

more than 2/100’s of 1%.

Staff validated a similar experience in a sample of other localities,

to include Prince William County, Hanover County, and the cities of Poquoson

and Williamsburg. Staff is unaware of

any localities that have switched back to requiring the display of decals

following the initial elimination— an indicator that this collection experience

is common among other jurisdictions.

This is primarily due to the robust collection tools Virginia jurisdictions have under state law, which include the ability to block DMV registrations, claim income tax refunds via the state’s Set Off Debt program, and execute seizures of bank accounts, wages, and property. It also speaks to the fact that most taxpayers simply comply with the law either out of respect for their civic duty, and/or to avoid the associated penalties and hassle of entering into the collection process.