[Archived] Question #09: Provide a memo to City Council with additional background on the long-term forecasting of City debt, debt service, and debt ratios.

Question:

Provide a memo to City Council with additional background on the long-term forecasting of City debt, debt service, and debt ratios.

Response:

The purpose of this memorandum is to provide City Council with additional detail on the City’s long-term forecasting of City debt and debt service, and their impact on the City’s adopted ratios for the management of debt.

The City uses borrowing as one of many financing tools to fund projects in the Capital Improvement Program (CIP). Through the careful management of debt, including the adoption of- and adherence to- the City’s debt management policies, the City has been able to achieve and maintain an AAA/Aaa bond rating status.

“Note: This budget memo, and related attachments, was updated on March 27, 2018 to correct an error in the originally published version. The Proposed FY 2019 – FY 2028 Debt Ratio Forecast chart (Attachment #1), originally used only Locally Assessed Taxable Real Property for forecasting FY 2018 – FY 2028 for the Debt as a Percentage of Real Property Value ratio, whereas Total Taxable Real Property Value should have been used for the ratio. The updated memo and attachments reflect this correction.”

Background

The Proposed FY 2019 – FY 2028 Capital Improvement Program assumes borrowing in the amount of $1.1 billion to fund capital infrastructure needs. Included in that amount are $310.4 million in bonds for the Sanitary Sewer projects backed by Sanitary Sewer System Capital Investment & Maintenance Fee, and $42.0 million in bonds for Stormwater Management projects backed by the Stormwater Utility Fee. A total of $749.9 million in bonds are planned over the ten years for other City projects, including Alexandria City Public Schools capital infrastructure needs (borrowing comprises $293.6 million of future ACPS capital costs in the ten-year plan, primarily associated with school capacity projects).

The plan also assumes the re-payment of $785.0 million in principal payments on prior year and planned bond issuances. Of this $785.0 million in principal payments, $148.3 million will be paid through Sanitary Sewer fees, Stormwater Utility fees, and the Potomac Yard generated tax revenues. The debt service on the remaining bonds is paid back through the City’s General Fund.

The City has historically issued all debt as general obligation debt, regardless of the source of payment. The City has the option to secure revenue-backed bonds for Sanitary Sewer and Stormwater Management projects, but opts against this as the revenue-backed bonds would not have as advantageous a bond rating and therefore the interest rate would be higher. By issuing Sanitary and Storm Sewer bonds with a general obligation (GO) pledge even though there is a user-fee generated revenue stream, the City achieves the lowest interest rates possible. Because of the GO pledge and user fees, these bonds are considered “double barreled” and do not count against the City’s debt ratios, per rating agency practice.

When issuing debt, the City pursues an aggressive repayment plan for borrowing, to ensure the fiscal health and sustainability of the City, and also to ensure a continued favorable bond/credit rating from rating agencies. Additionally, the City continues to monitor the current bond market and pursues bond refinancing opportunities that are beneficial to the City. In the last two fiscal years alone, the City has refinanced to lower interest rates $183.5 million of debt from previous issuances, to take advantage of more favorable interest rates and reduce the cost of borrowing.

Debt Ratios and Current Performance

City Council passed a set of debt-related financial policies on June 9, 1987. During FY 1998, the Budget and Fiscal Affairs Advisory Committee (BFAAC), a City Council appointed citizen committee, analyzed these debt-related financial policies, and examined the City’s financial condition in comparison to other jurisdictions with superior credit ratings (other double-triple A rated jurisdictions). The BFAAC and the City Manager recommended that City Council reaffirm the updated debt-related financial policies, incorporating BFAAC’s recommended updates to the policies to establish a consistent set of appropriate relationships between debt targets and limits.

City Council reaffirmed its commitment to sound financial management and adopted the updated debt-related financial policies on December 9, 1997. City Council amended the policies on October 26, 1999, to allow priority consideration for an increase in the assignment of fund balance for capital project funding. On June 24, 2008, City Council adopted the City Manager's recommendation, endorsed by BFAAC, to revise the target and limit upward, reflecting the ratio of debt as a percentage of total personal income.

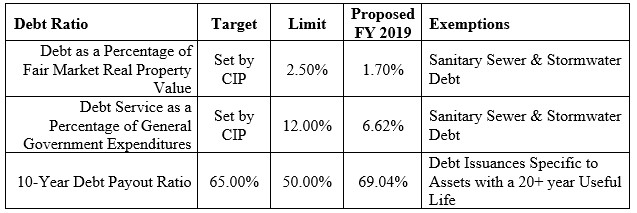

As part of the FY 2018 – FY 2027 CIP, City Council approved modifications to the City’s Adopted Debt Ratios, endorsed by BFAAC, that adjusted ratio limits, eliminated the debt as a percentage of total personal income ratio, and added a debt repayment rapidity measure. The table below outlines the current adopted debt management ratios:

Each year the debt proposed by the Proposed FY 2019 – FY 2028 CIP stays within these approved limits for the Debt as a Percentage of Fair Market Real Property Value, Debt Service as a Percentage of General Government Expenditures, and the 10-Year Debt Payout ratios.

Debt Ratio Forecast Chart

Attachment #1 provides an overview of the City’s long-term forecasting of outstanding debt on active and planned debt issuances, the debt service that results from active and planned issuances, and the impact of debt and debt service on the City’s adopted debt management policies. This chart also incorporates the amount of debt that the City plans on retiring on active and planned issuances over the 10-year period.

This section of Attachment #1 details the City’s outstanding debt, categorized into major areas of expenditure, include debt financing for City projects, School projects, anticipated taxable bonds for future development projects, fee-back debt financing for Sanitary Sewers and Stormwater Management, and debt related to the Potomac Yard Metrorail station (ex. Virginia Transportation Infrastructure Bank loan). This section also notes that amount of debt that will be retired through principal debt service payments.

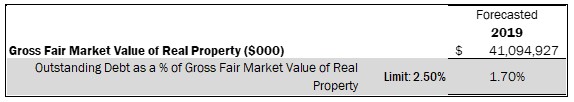

Debt issued for Sanitary Sewer and Stormwater Management projects are exempted from the City’s adopted outstanding debt ratio (debt as a percentage of fair market value of real property), as the debt service on this borrowing is paid via the Sanitary Sewer System Capital Investment & Maintenance Fee, and the Stormwater Utility Fee. As such, this chart removes Sanitary/Stormwater outstanding debt from the calculation of ratio. At the end of fiscal year 2019, the City will have $743.0 million in outstanding debt, of which $44.2 million is related to Sanitary Sewers and Stormwater Management projects. This results in $698.8 million of outstanding debt which is applicable to the debt ratio.

This section of Attachment #1 details the anticipated debt service that the City will incur from active and planned debt issuances. The debt service is separated out into debt service attributable to City and school projects.

Debt service attributable to Sanitary Sewer and Stormwater Management projects are also exempt from the Debt Service as a Percentage of General Government Expenditures ratio, as the debt service on this borrowing is backed by the Sanitary Sewer System Capital Investment & Maintenance Fee, and the Stormwater Utility Fee. In the Proposed FY 2019 budget, the City anticipated $72.2 million in debt service related to active debt issuances and the planned FY 2019 debt issuance, of which $3.5 million of the debt service can be attributed to Sanitary Sewer and Stormwater Management projects. This results in $68.7 million in debt service that is applicable to the debt service ratio.

Debt Management Ratios

This section of Attachment #1 details the anticipated performance over the 10 years for the debt as a percentage of fair market real property value and debt service as a percentage of general government expenditures. This section also outlines the 10-year payout ratio on existing and planned debt as of the start of FY 2019.

Outstanding Debt as a Percentage of Gross Fair Market Value of Real Property indicates the relationship between the City’s debt and the full value of real property in the City as assessed annually at fair market value. It is an important indicator of the City’s ability to repay debt because real property taxes are the primary source of the City’s revenues used to repay debt. A small ratio is an indication that the City will be better able to withstand possible future economic downturns and continue to meet its debt obligations.

In the Proposed FY 2019 Capital Budget, the City will achieve a ratio of 1.70%, which is compliant with the adopted ratio limit.

Debt Service as a Percentage of General Government Expenditures measures the City’s ability to repay debt without hampering other City services. A small ratio indicates a lesser burden on the City’s operating budget.

In the Proposed FY 2019 Capital Budget, the City will achieve a ratio of 6.62%, which is compliant with the adopted ratio limit.

The 10-year Debt Payout Ratio is a measure of how aggressively the principal of City debt is structured to be paid back. Level debt service or equal principal payments across each year of a 20-year issuance would result in a payout ratio of 50%. The City has achieved a payout ratio of more than 60 percent as a result of the number of years in which more debt is retired than new debt is issued. The payout ratio for each individual year of the CIP is less relevant as an indicator than an examination of the entire debt portfolio.

Including the planned FY 2019 issuance, the City will have $789.0 million of outstanding debt as of the beginning of the fiscal year. By FY 2028 (Year 10), the City anticipates having paid $544.7 million in principal on this debt, which results in a 69.04% payout ratio. This payout ratio is both compliant with the adopted ratio limit and exceeds the adopted ratio target.

ATTACHMENTS:

Attachment 1 - Proposed FY 2019 - FY 2028 Debt Ratio Forecast