[Archived] Question #61: Revenue Re-estimate and Technical Adjustments for Add/Delete

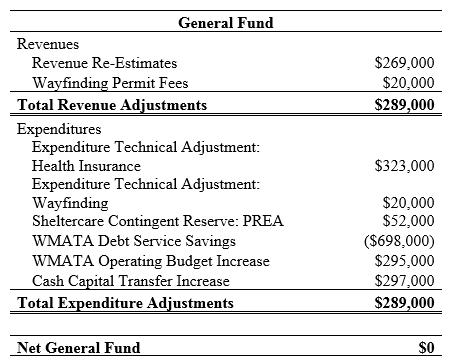

The purpose of this memorandum is to inform City Council of the technical budget adjustments proposed by staff as part of the add/delete process. This represents the final revenue and expenditure update before the add/delete process. The sum of revenue re-estimate and technical adjustment expenditure changes are equal, with no net surplus or deficit to address in add/delete. The major changes from the proposed budget are reflected in the chart below and discussed on the following pages.

Revenue Changes

Annually, at the beginning of April, City staff re-estimates current fiscal year and subsequent fiscal year revenues based on additional months of collection data. The result of those projections shows a projected overall increase compared to the amount estimated in the City Manager’s Proposed Budget of a net increase of $269,000.

The following table below includes the FY 2018 revenue estimation changes from February to April. Most of these changes reflect the final State budget adopted by the General Assembly which increased revenues to the City by $509,000 for FY 2018.

The revenue re-estimates described in detail below reflect current tax rate and revenue policies continued or already reflected in the FY 2018 Proposed Budget.

The FY 2018 revenue estimates in the FY 2018 Proposed Budget were based on revenues and trends through December 2016. The latest estimates are based on revenue collections through March 2017, with exceptions as noted below. Based on actual receipts and trends through March, the FY 2018 revenue estimates have been changed as detailed below. These technical revenue adjustments will be reflected on the preliminary and final Add/Delete list.

Expenditure Changes

Health Insurance Technical Adjustments

Health Insurance: As part of Budget Question #28, City staff informed Council of a higher than budgeted cost of health insurance in FY 2018 and ways to pay for the increase. The estimate in that memo was based on an initial set of rates provided by the City’s healthcare consultant. After that estimate was provided to staff, one of the City’s health insurance carriers revised its cost increase downward. This resulted in reducing the City’s General Fund cost increase from $1.6 million above the FY 2018 proposed budget to an increase of $1.2 million. The previously proposed reductions to the OPEB contribution ($612,000) and to the contingent reserve ($100,000) have been restored.

APD Equipment: The proposed budget included $1.5 million for 17 over hire police officer positions in each of two annual recruit classes to cover attrition. The total cost included salaries and benefits for the additional officers and non-personnel costs for their uniforms and equipment. Because some non-personnel items must be purchased new for each officer (uniforms, body armor, and ammunition for training) and some may be handed down through attrition (radios and firearms), the proposed budget included $204,000 baseline funding and a $369,000 set aside until the final costs could be determined. The final estimate for non-personnel is $233,000, leaving $340,000 available for reallocation.

Vacancy Savings: Each annual operating budget assumes a vacancy savings of salaries and related benefits such as health insurance. In general, more vacancy savings occurs than is deducted from the operating budget. This gives City staff some margin for risk mitigation if less turnover occurs than normal, or to cover unexpected or unavoidable expenses. Staff continue to monitor potential staff turnover and believe that increasing the vacancy savings by $555,000 is one that City staff believes can be managed based on current staffing conditions.

Sheltercare Contingent Reserve

Sheltercare Contingency: After the FY 2018 proposed budget was released, City staff was informed that the Sheltercare facility would be subject to the minimum staffing ratios prescribed by the federal Prison Rape Elimination Act (PREA). As a result, Sheltercare staff estimates that they will require one additional staff person above current funding levels to meet this mandate. City staff is working with Sheltercare to answer additional questions about this request including the possibility of absorbing this cost in FY 2018. As such, City staff is recommending placing this funding in Contingent Reserves in the event it is needed in FY 2018.

WMATA Adjustments

Debt Service: Reducing the CY 2017 general obligation bond issuance as a result of being included in WMATA’s now planned debt issuance and not opting out and issuing our own debt will result in a debt service savings to the City of $698,000 for FY 2018. While WMATA interest rates may be slightly higher than the City’s, having WMATA issue this debt will preserve City debt capacity.

WMATA Operating Contribution: The Proposed Operating Budget included $39.98 million for the City’s contribution to WMATA’s operating budget. Following budget proposal, the City’s share of the WMATA operating contribution was revised as a result of the WMATA Board adoption and increased to $40.28 million; an increase of $295,000.

Cash Capital Increase

Cash Capital: After funding a portion of the health insurance increase, the Sheltercare contingency, and the WMATA operating contribution increase, the remaining savings of $297,000 is being transferred to cash capital to further reduce the CY 2017 bond issuance and increase the City’s debt capacity for future years and needs related to City and ACPS capital projects.

Non-General Fund Changes

Special Revenue Fund

Personal Responsibility Education Program (PREP Grant): As part of a subsequent review of grant funds, City staff identified that the PREP grant had been partially double budgeted in two different accounts. This adjustment reduces the planned grant expenditures by $80,537 to $299,699, which is what the City expects to receive for this program.

Capital Projects Fund

WMATA Capital Contribution: The Proposed CIP included a total of $37.0 million for the City’s WMATA Capital Contribution. Following budget proposal, the City’s share of the WMATA capital contribution was revised as a result of the WMATA Board adoption and increased to $41.2 M. For FY 2018, WMATA is giving jurisdictions the option of opting in to a WMATA sponsored debt issuance for portions of the FY 2018 capital contribution. For FY 2018, this reduces the City’s WMATA Capital Subsidy to $17.13 million; a total reduction of $19.87 million. Staff is recommending a reduction in borrowing by $15.87 million and a reduction in the planned use of State funding through NVTC for WMATA by $4.0 million in order to preserve transportation funding in anticipation of potential FY 2019 cost increases and potential State and federal funding reductions.

General Fund Cost Redistribution

The Non-Departmental General Fund budget includes compensation adjustments for the addition of a new step at the top of the employee pay scale ($798,000), savings from the adjustment in calculation of the supplemental retirement lump sum payout ($798,000), and group life insurance rate increases ($104,000) that will be redistributed to departments in the approved budget appropriation. There is no net new cost to the budget as these are zero-sum cost neutral transfers.