[Archived] Question #19: Please prepare a summary and graph of the City's unfunded OPEB liability and history.

Question:

Please prepare a summary and graph of the City's unfunded OPEB liability and history.

Response:

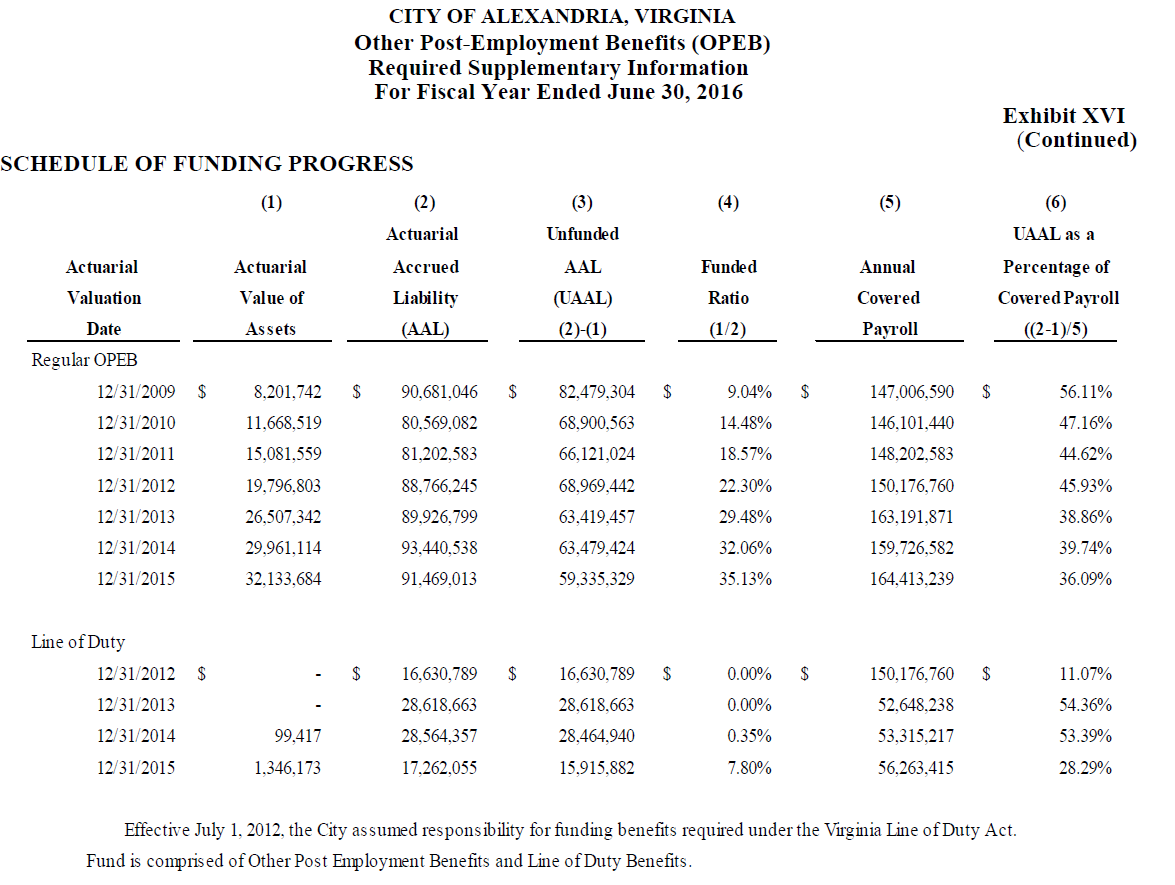

The following chart appears in the City’s Comprehensive Annual Financial Report and shows the funding progress for the Other Post-Employment Benefits Fund, which is comprised of both Other Post-Employment Benefits (OPEB) and Line of Duty Benefits (LOD).

The OPEB fund was established in calendar year 2008, and the City took on funding responsibility for the LOD Act from the State in July 2012. Both are relatively new funds. Beginning in 2013, each liability was reported separately. Based on the actuarial valuation date of December 31, 2015, the most recent date of available information, the funded ratio of OPEB is at 35.13% and the Line of Duty Act Fund has a funded ratio of 7.80%.

Each year, the budget is developed based on the actuarially-determined, Annual Required Contribution (ARC), which is calculated as a percent of the salaries of employees covered by the plan. As the Line of Duty Act Fund becomes more mature, the ARC percentage is increasing. As of June 30, 2016, the percentage of the ARC that was contributed was 74.2 percent. The FY 2018 Operating Budget reflects 100 percent funding of the ARC for both pension plans.