[Archived] Question #10: What is the impact on the real estate tax rate of fully funding the Supplemental CIP? How would fully funding the Supplemental CIP impact the City’s debt ratios?

Question:

What is the impact on the real estate tax rate of fully funding the Supplemental CIP? How would fully funding the Supplemental CIP impact the City’s debt ratios?

Response:

The Proposed FY 2018 – FY 2027 CIP includes an unfunded supplemental CIP that totals $325.2 million over the 10-year plan. Of this amount, $203 million is related to ACPS projects and the remaining $122.2 million is for other City projects.

The cost to fully fund the supplemental CIP from real estate taxes would require a six to ten cent rate increase depending on the mixture of cash and bonds used to fund the projects.1 However, either the 50% bond option (six cent increase) or the 25% bond option (seven cent increase) increases the City’s debt very close to the proposed new debt ceilings, limiting the City’s future abilities to leverage debt as a financing mechanism to react to capital infrastructure needs that are not currently known or expected. Therefore, a third cash-only option needs to be considered (ten cent increase). If the Supplemental CIP was scheduled so that the $325.2 million capital expenditure was spread evenly over a 10-year period, then the tax rate increase needed to support that would decrease from about 10 cents to 8 cents.2

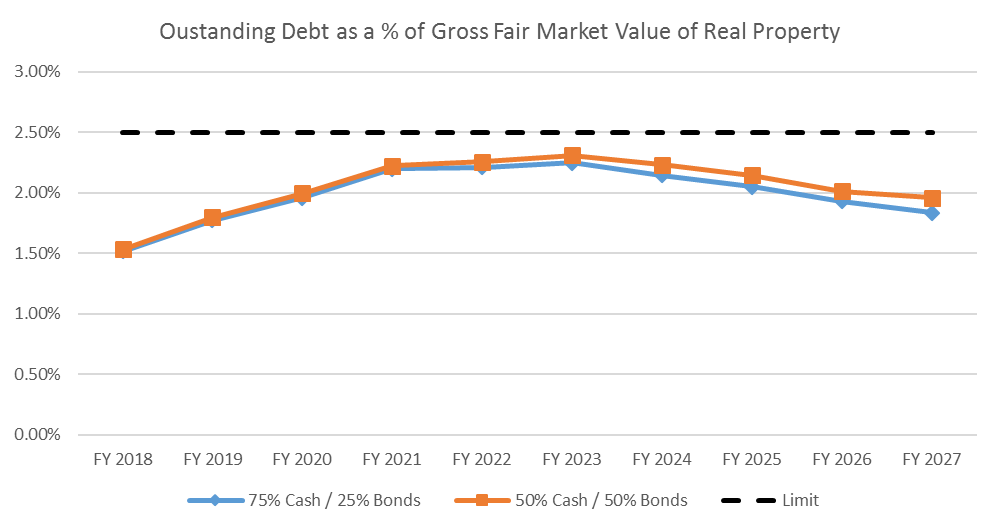

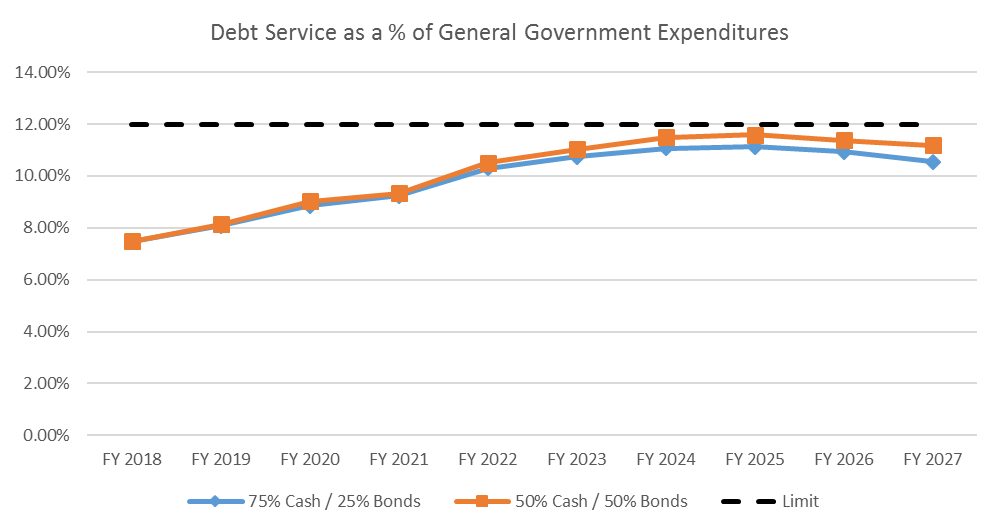

The charts below show the impact of the two funding options that utilize debt to fully fund the supplemental CIP on the proposed debt ratios.

Full funding of the supplemental CIP, even when limiting debt financing to 50%, would create significant pressure on the proposed debt ratios. This will limit the City’s future abilities to leverage debt as a financing mechanism to react to capital infrastructure needs that are not currently known or expected.

1The six-cent option assumes 50% bond funding and 50% cash funding of the supplemental CIP. Funding from 25% bonds and 75% cash would require a seven-cent rate increase. Funding entirely from cash would require a ten-cent increase.

2 The tax rate calculations are all approximate and rounded to the nearest cent.