[Archived] Question #3: How much would the real estate tax rate and average tax bill increase if the ACPS operating transfer was fully funded?

Question:

How much would the real estate tax rate and average tax bill increase if the ACPS operating transfer was fully funded? How much would the tax rate and average bill increase if the CIP was fully funded? What is the history of City funding for the ACPS Approved operating budget and CIP?

Response:

The FY 2018 proposed budget includes a 2.7 cent increase in the real estate tax rate and a $197 increase in the average residential tax bill, of which $54 is due to assessment growth and $143 is the result of the proposed rate increase. Fully funding the ACPS approved operating transfer from real estate taxes would add another 0.6 cents to the rate and increase the average residential tax bill by $32 above the proposed increase. Fully funding the ACPS portion of the City’s unfunded supplemental CIP from real estate taxes would add another five to eight cents to the rate and increase the average residential tax bill by $264 to $423 above the proposed increase. Doing both would increase the tax rate by 5.6 to 8.6 cents and increase the average residential tax bill by $296 to $454 above the proposed increase.

| Average Tax Bill | Increase Over Proposed Budget | Increase Over FY 2017 | |

| Proposed Budget | $5,813 | $0 | $197 |

| + 0.6 Cents for Operating | $5,844 | $32 | $228 |

| + 5 to 8 Cents for Capital | $6,077 to $6,235 | $264 to $423 | $461 to $619 |

| +5.6 to 8.6 Cents for Both | $6.109 to $6,267 | $296 to $454 | $493 to $651 |

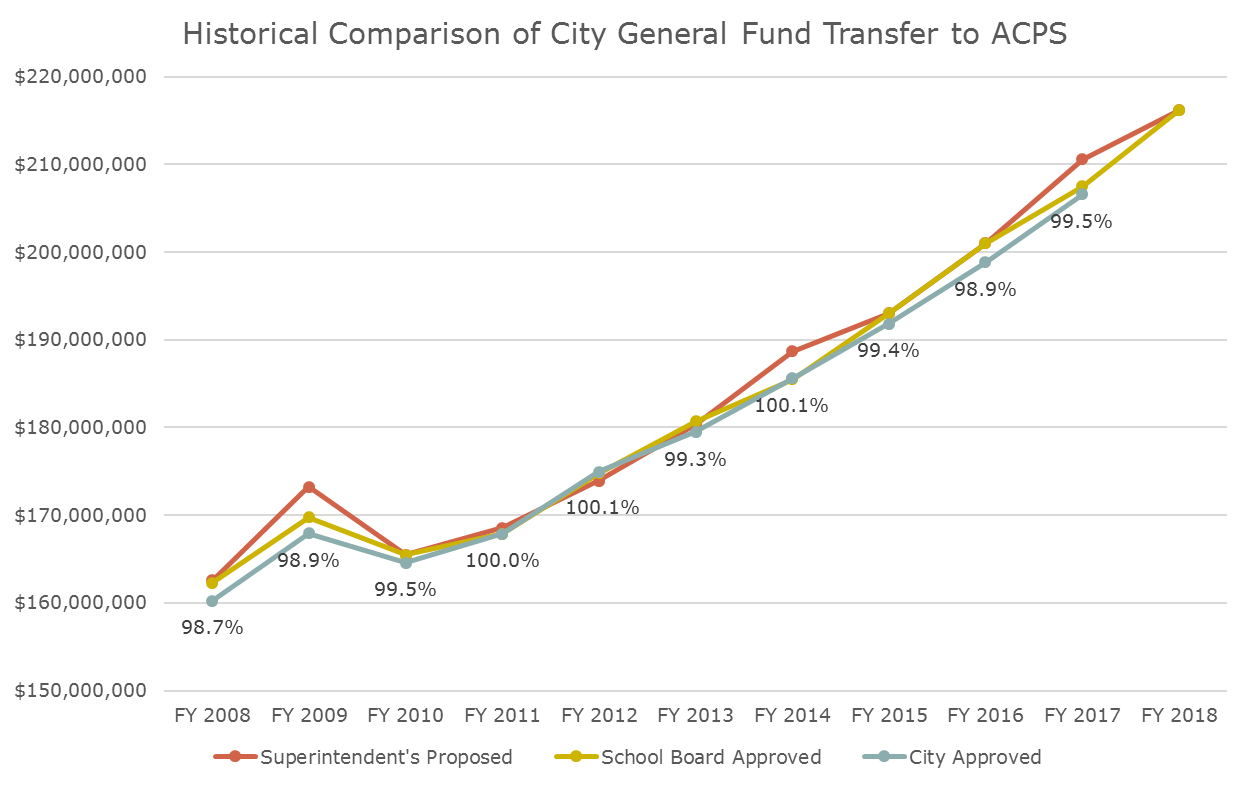

Historically, the City has funded 98.5% to 100.1% of the ACPS approved operating transfer over the past ten years and fully funded year one of the ACPS approved CIP in 11 of the past 15 years. More details on the cost to fully fund the ACPS approved operating budget and the ACPS portion of the supplemental CIP and historical City funding of the ACPS operating budget and CIP follows.

General Fund Operating Transfer: An additional 0.6 cents above the already proposed 2.7 cent increase would be required to fully fund the ACPS operating transfer of $216.1 million, which is $2.1 million more than the City Manager’s Proposed ACPS General Fund Operating Transfer. The average tax bill would increase from $5,813 to $5,844, an additional $32 above the $197 planned increase in FY 2018 due to real estate assessment growth and the proposed 2.7 cent increase for a total increase of $228 per household.

Capital Improvement Program (CIP): The ACPS School Board adopted its ten-year CIP on December 15, 2016 which totaled $611.1 million for FY 2018 – 2027, and exceeded the School

Board’s prior CIP for FY 2017 – 2026 by $319.9 million. The City Manager’s Proposed FY 2018 – 2027 CIP includes funding over ten years for Alexandria City Public Schools (ACPS) totaling $373.0 million, which represents a $143.2 million or 63% increase in City funding over the prior City CIP. The City Manager also presented a $325 million unfunded supplemental CIP which included $203 million of additional ACPS capital funding. The cost to fully fund the ACPS portion of the supplemental CIP from real estate taxes would require a five to eight cent rate increase depending on the mixture of cash and bonds used to fund the projects.1 However, either the 50% bond option (six cent increase) or the 75% bond option (five cent increase) increases the City’s debt very close to and at times slightly over the proposed new debt ceilings. Therefore, a third cash-only option needs to be considered (eight cent increase). If ACPS scheduled the $203 million capital spend over a 10-year period (instead of 7 years) then the tax rate increase needed to support that would drop from about 8 cents to 5 cents.2

Fully funding the ACPS portion of the supplemental CIP would cost between $20 million and $29 million per year in debt service and/ or cash capital over the next seven years, with debt service continuing but decreasing for twenty more years following those seven years. The real estate tax rate increase needed to fund this increase would be between five and eight cents, increasing the average tax bill by $264 to $423 more than the proposed 2.7 cent rate increase.

Historical Funding of ACPS Operating Transfer & CIP

Operating Transfer:

Historically, over the period from FY 2008 to FY 2017, City Council has funded between 98.7% to 100.1% of the School Board Approved General Fund Transfer. In FY 2018, the City Manager proposes funding $214,061,472 or 99.0% of the School Board Approved General Fund Transfer ($216,149,404).

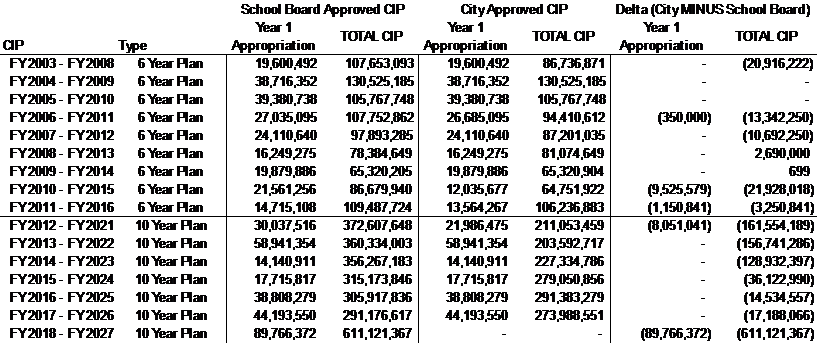

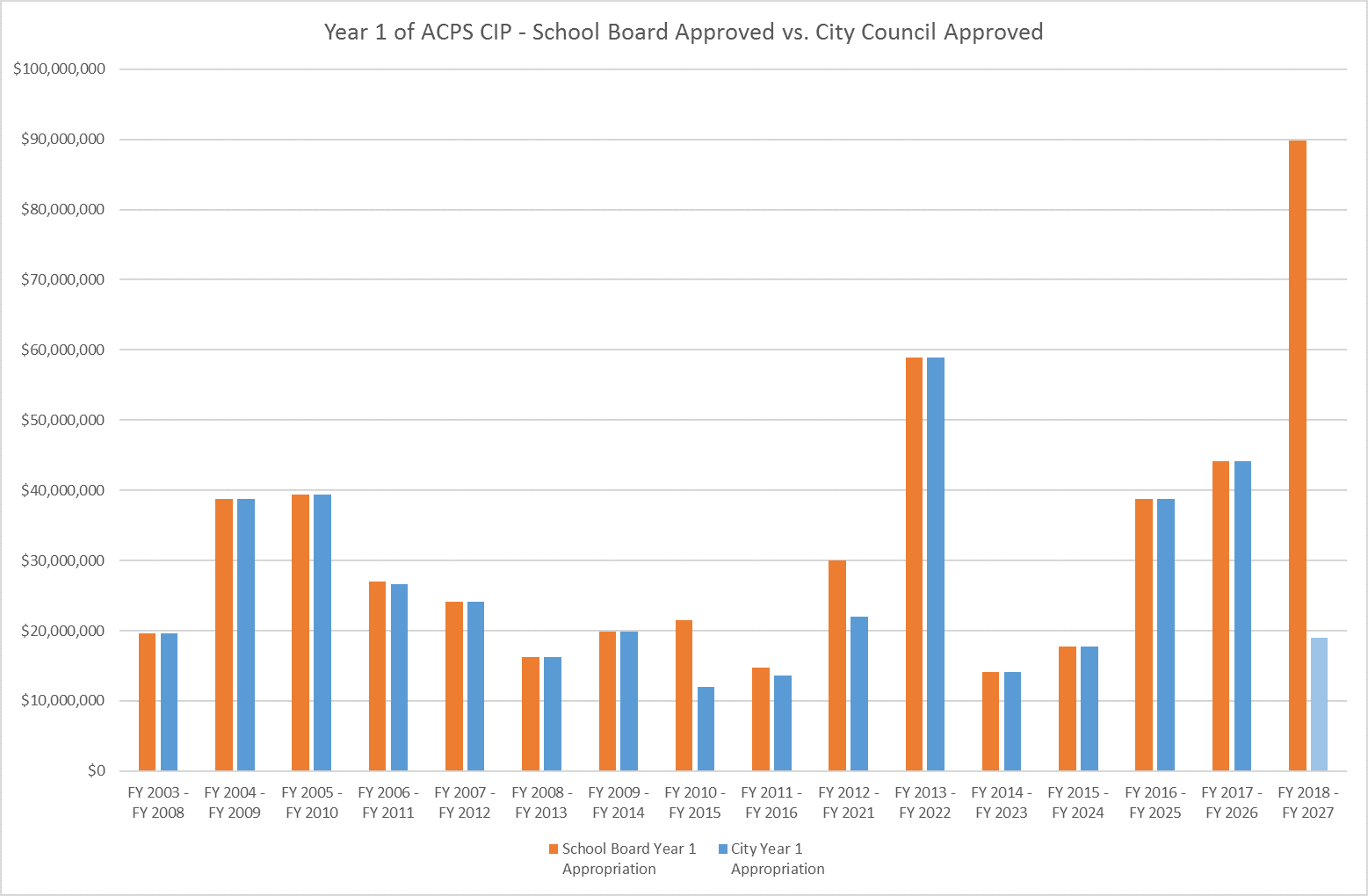

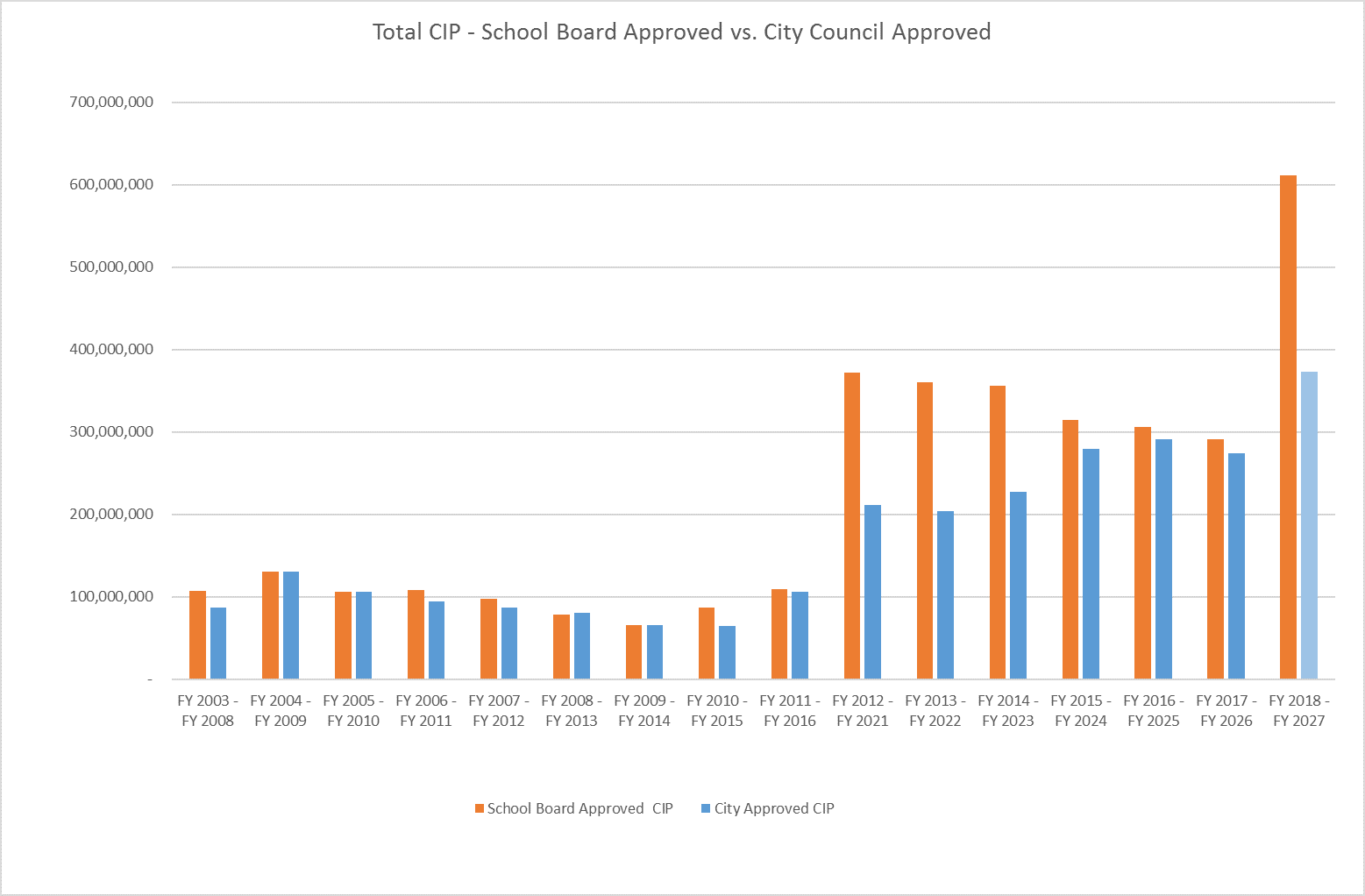

CIP:

The following table provides a 15-year history of the School Board’s Approved CIP and the ACPS funding included in each City Council Approved CIP. It is important to note that prior to FY 2012, the City and ACPS CIPs were six-year plans, as opposed to the current 10-year plans. As illustrated in the table, the School Board and City Council Approved CIPs differ significantly when comparing the plans in total, however, when comparing the first year of the plans, the City has matched the School Board’s capital request for 11 of the last 15 years. The City’s ten-year planned dollar amount has also increased in four of the past five years.

The following charts compares School Board and City Council Approved CIP funding for year one and the life of each plan from FY 2003 and FY 2018.

*FY 2018 - FY 2027 City amount reflects the City Manager's Proposed CIP

*FY 2018 - FY 2027 City amount reflects the City Manager's Proposed CIP

1The five cent option assumes 75% bond funding and 25% cash funding of the ACPS portion of the supplemental CIP. Funding of from 50% bonds and 50% cash would require a six cent rate increase. Funding entirely from cash would require an eight cent increase.

2 The tax rate calculations are all approximate and rounded to the nearest cent.