[Archived] What are the FY 2017 budget add/delete items that are eligible for consideration in the Preliminary Add/Delete work session on Tuesday, April 26, 2016?

This memorandum

summarizes the list of FY 2017 budget add/delete items eligible for

consideration in the Preliminary Add/Delete work session on Tuesday, April 26,

2016 in City Council Chambers at 6:00 pm. City Council’s Add/Delete submissions

are described and provided as Attachment 3.

REVENUES

Revenue Re-Estimates: +306,627 (Budget Memo

#18)

Revenue re-estimates

developed by staff and summarized in Budget Memo #18 (Attachment 1) include a

$306,627 increase in FY 2017 General Fund revenues based on actual FY 2016

billings and collections through March. Of that additional revenue, $94,200 is

needed to fund technical expenditure adjustments outlined in Budget Memo #18,

leaving a net of $212,427 available to fund additional expenditures in the

budget.

In addition to the

increased revenues available due to re-estimates, several tax and fee increases

have also been proposed for consideration in Add/Delete.

Real Estate Property Tax Increase (Up to 2.0

Cents): +10,245,600 Maximum Increase

City Council

advertised a maximum real estate property tax rate of $1.073 per $100 of

assessed value, a three (3) cent increase over the current rate, on March 15,

2016 and heard public testimony on April 16, 2016. The FY 2017 proposed budget

includes a one (1) cent increase. In advertising the maximum three (3) cent

increase, Council directed staff to develop a recommendation for capital

projects to be funded by the additional two (2) cents and summarized in the

expenditure section of this memorandum.

Cigarette Tax Increase (11 Cents): +$160,555

Add/delete options

include a proposal to increase the tobacco tax by 11 cents from the current

rate of $1.15 per pack to $1.26 per pack. The increase would generate an

additional $160,555 in revenue. A portion of the increase is proposed to

restore a reduction in Northern Virginia Dental Clinic funding included in the

proposed budget $57,914. The remaining $102,641 is proposed to increase funding

for Neighborhood Health.

Residential Refuse Collection Fee: +$182,490

Add/delete options

include a $10 increase in the residential refuse collection fee to implement

the trash and recycling can component of the City’s approved Citywide Parks

Improvement Plan and expand the availability of public space recycling cans.

The proposed budget includes a $16 fee increase, from $337 per household to

$353 due to a reduction in the value of recyclable materials sold by the City

to offset expenditures. This proposal would increase the fee to $363 in FY

2017.

EXPENDITURES

Expenditure Technical Adjustments: +$94,200

(Budget Memo #18)

Since presenting the

proposed budget, staff has identified expenditure adjustments for FY 2017

including increases and decreases not included in the proposed budget due to

the timing of their identification. They are summarized in Budget Memo #18

(Attachment 1) and total $94,200, which can be funded by the additional

$306,627 in General Fund revenue identified through re-estimates, leaving

$212,427 available for other expenditures.

Washington Metropolitan Area Transit

Authority (WMATA) Savings: -$566,102 in the Operating Budget and -$850,000 in

the Capital Improvement Program (CIP) (Budget Memo #18)

Included in the expenditure technical adjustments are changes in the City’s share of WMATA operating and capital funding made by WMATA following the presentation of the City’s proposed budget, along with staff’s recommendations that the operating savings be used to increase funding for the City’s Transportation Improvement Program (TIP) by $566,102 and the capital savings be used to increase the City’s Street Resurfacing CIP project by $850,000. The specific use of the TIP funds could be determined by City Council at a later date based on the recommendation of the Transportation Commission.

Capital Project Funding: Up to +$10,245,600

The City Manager’s

FY 2017 proposed budget includes a one cent increase in the real estate tax

rate. At their March 15, 2016 meeting to set the maximum tax rate for calendar

year 2016, City Council set the maximum increase at three cents and directed

the City Manager to provide options for investing the additional two cents on

capital projects. The addition of two cents on the real property tax rate would

provide an additional $7.6 million in revenue in FY 2017 and $3.8 million from

the second real estate tax payment of FY 2016 for a total of $11.4 million, of

which $1.1 million would be required to comply with the City’s policy of

retaining 10% of revenue in fund balance and $10.2 million would be available

as cash capital funding for projects.

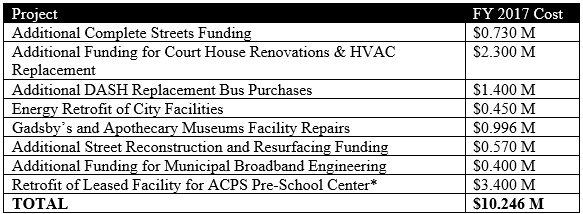

Staff recommends applying two-thirds of the additional revenue ($6.8 million) as cash capital to fund City transportation, facilities and broadband projects and using one-third ($3.4 million) to fund the ACPS approved Pre-K Center through a combination of cash funding and borrowing. ACPS projects represent approximately one-third of the FY 2017 CIP (excluding the Potomac Yard Metrorail station). The projects listed in the following table represent the City Manager’s recommendation for additional investment should Council choose to fund additional capital projects in FY 2017.

*In addition, $5.172

million would be borrowed to fund the total $8.3 million needed to fund the

retrofitting of the leased space.

City Council only

needs to identify use of the funds generated by the additional two cents on the

tax rate for FY 2017. Staff will plan to program these funds as cash capital

for projects related to transportation, ACPS, and City facilities in future

years of the Capital Improvement Program.

A summary description of each of these projects is included as Attachment 2 to this memorandum.

Energy and Sustainability Project Manager

+$70,000 (CIP Funded)

One add/delete

option is to fund a capitalized Energy and Sustainability Project Manager

position in the CIP to assist the City in achieving the Environmental Action

Plan by participating in regional sustainability projects to demonstrate new

technologies, thus reducing costs and risks to Alexandria; by promoting best

green practices to reduce costs to homeowners and at the same time ecological

impacts to the environment; by assisting in incorporating sustainability goals

and practices into Small Area Plans, such as the Eco-District concept for Old

Town North and Eisenhower West, and ensuring that the City’s sustainability

goals are largely paid for by developers; and by working with City departments

and the Environmental Policy Commission to accelerate the updating of the

City’s Green Building Policy as well as the Environmental Action Plan. This

proposal is for partial year funding (six months) in FY 2017 and would require

a $70,000 reduction in funding for the projects recommended by staff.

Dental/Health Care for the Uninsured

+$160,555 (Cigarette Tax Funded)

This proposal would

use revenue generated by the proposed 11 cent increase in the cigarette tax to

restore funding to the Northern Virginia Dental Clinic reduced in the City’s

proposed budget ($57,914), fund an additional 0.5 FTE Family Nurse Practitioner

or Physician at Neighborhood Health to serve an additional 1,300 health care

visits by 600 or more adults ($87,878) and provide an additional $14,763 in City

funding for Neighborhood Health.

Parks and Public Space Recycling +$182,490

(Residential Refuse Collection Fee Funded)

This proposal would

use revenue generated by the proposed $10 increase in the residential refuse

collection fee to implement the trash and recycling can component of the

approved Citywide Parks Improvement Plan ($163,469) and to expand the

availability of public space recycling cans ($19,021).

Child Care Fee Subsidy +$409,969 (Funded by Offsetting

Expenditure Reductions)

This proposal would

eliminate approximately 13% of the existing waiting list for the Child Care Fee

Subsidy program by providing care for 58 low income children thereby reducing

the existing 10 month wait for services. In order to fund this increase, the following

corresponding expenditure reductions to new positions added in the FY 2017

proposed budget are proposed.

- Police Motor Officer Sergeant -$100,000: The proposed budget includes $400,000 in

Contingent Reserves to fund increased traffic and speeding enforcement. Staff

recommends that Council transfer the funds to the Police Department to create

two motor officers and one supervisor and increase overtime for traffic and

speeding enforcement. The current staffing is nine (9) officers and one

supervisor. The staff recommendation would increase the number of officers to

11 and add a second supervisor. This proposal would add two officers but not

the second supervisor for a savings of $100,000 to increase the Child Care Fee

Subsidy.

- Northern Virginia Juvenile Detention Center (NVJDC) Staffing -$174,000:

NVJDC is a regional facility

located in the City and shared by Arlington County and the City of Falls

Church. The NVJDH proposed adding eight (8) staff positions to increase

staff-to-youth ratios to meet a federal Prison Rape Elimination Act (PREA)

mandate scheduled to go into effect in FY 2018. Adding the positions in FY 2017

would enable NVJDH to begin recruitment and training before the mandate takes

effect. Following the presentation of the City’s proposed budget, NVJDH reduced

its staffing request to six (6) positions at a cost of $112,000. Staff

recommended budgeting the $112,000 increase in the Other Public Safety budget

for NVJDH and retaining $62,000 in a City Council Contingent Reserve. This

proposal would delay the NVJDH hiring until FY 2018 and eliminate the

Contingent Reserve to increase Child Care Fee Subsidy funding by $174,000.

- ITS Business Analyst -$135,969: The proposed budget includes the addition of one (1) new Business

Analyst in the Information Technology Services (ITS) department to assist City

departments with the analysis, design, configuration, testing, and maintenance

of IT system work processes. This proposal would remove the addition of this

position from the FY 2017 budget to increase Child Care Fee Subsidy Funding by

$135,969.

Proposals for Use of the Additional Revenue

Identified through Re-estimates +$212,427

The following items

have been proposed to be funded by the increased General Fund revenue

identified through re-estimates and outlined in Budget Memo #18. In total, the

sum of these items ($294,707) is $82,280 greater than the amount of revenue

available ($212,427), so not all could be funded at the amounts proposed. They

are listed in order of the amount proposed from highest to lowest.

- Fire Hydrant Maintenance +$100,000: The proposed budget includes a reduction from the FY 2016 level of

funding that reduced fire hydrant preventive rebuilds from a five (5) year

cycle to a 10 year cycle. This proposal would restore the five (5) year cycle.

- Library Sunday Hours +$79,862: This proposal would open the three (3) branch libraries for four (4)

hours on Sundays, from 1:00 pm to 5:00 pm.

- Visit Alexandria Digital Advertising +$50,000: This proposal would partially restore

funding eliminated from the budget in FY 2016 ($75,000) to update Visit

Alexandria’s digital advertising material’s content.

- Old Town Business Improvement District (BID) Study +$25,000: This proposal would provide one-time funding

to study the feasibility and best practices for structuring and funding an Old

Town BID.

- Park Maintenance +$22,365: The proposed budget includes a $23,459 reduction in park restroom maintenance, dog park maintenance, and litter pick-up from seven (7) days per week to (5) days per week. This proposal would mostly restore the funding for seven (7) day maintenance.

- Wheelchair Accessible Automatic Door Operator at City Hall +$10,200: This proposal would fund the installation of one wheelchair accessible automatic door operator at the Cameron Street entrance to City Hall.

- Recreation Center Hours +$7,280: This proposal would restore walk-in hours at the Nannie J. Lee Recreation Center that were eliminated in the proposed budget.

ATTACHMENTS:

Attachment 1 - FY 2017 Budget Memorandum 18

Attachment 2 - Capital Projects Recommended for Funding by an Additional Two (2) Cent Increase in the Real Estate Property Tax Rate

Attachment 3 - City Council’s FY 2017 Preliminary Add/Delete Submissions