[Archived] How does the average Alexandria tax bill compare to other Northern Virginia jurisdictions?

The following is in response to Councilman Lovain’s request for a comparison of the City’s real estate tax bill for homes within a range of square footages to Arlington and Fairfax Counties. Other jurisdictions do not publicly offer average price-per-square-foot data with which to compare, however the City’s Real Estate Assessments staff was able to obtain the average property values broken out between single family homes and condominiums from Arlington, Fairfax and Loudoun Counties.

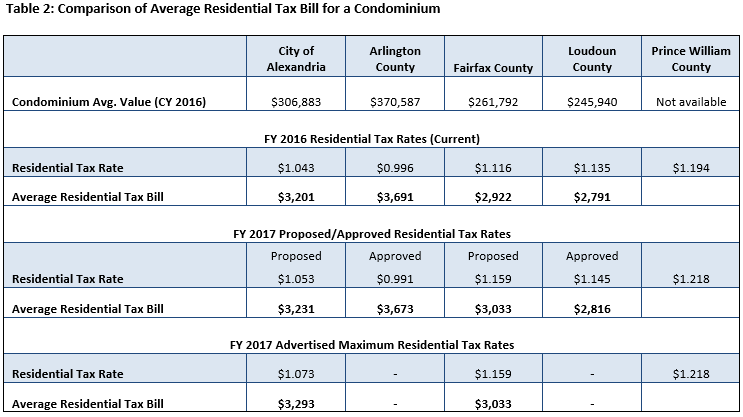

For calendar year (CY) 2016 the average single-family home, is assessed at $720,701, an increase of 2.25% or $15,918. Based on an increase in the average assessment on single-family homes, the average residential tax bill is $7,517. If the CY 2016 tax rate is increased to $1.053, the average residential tax bill will be $7,589, an increase of $72 annually or $6 monthly. Table 1 below compares the City’s average single-family home value and residential tax bill to other Northern Virginia Jurisdictions based on the current FY 2016 residential property tax rate, the FY 2017 proposed/approved residential property tax rate, and the FY 2017 advertised maximum residential property tax rate. Although Prince William County released their 2016 assessments, they have not prepared average residential assessment by classification of single-family and condominiums. Since Arlington and Loudoun County have adopted their budgets, the advertised maximum tax rate is no longer applicable to them.

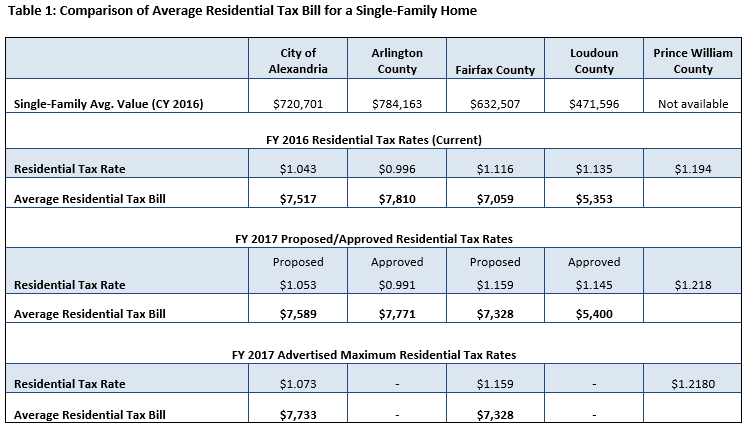

The 2016 average residential condominium is assessed at $306,883, an increase of 0.94% or $2,869 from the previous year. Based on an increase in the average assessment on condominiums, the average residential tax bill is $3,201. If the CY 2016 tax rate is increased to $1.053, the average residential tax bill will be $3,231, an increase of $30 annually or $2.50 monthly. Table 2 below compares the City’s average condominium value and residential tax bill to other Northern Virginia Jurisdictions based on the current FY 2016 residential property tax rate, the FY 2017 proposed/approved residential property tax rate, and the FY 2017 advertised maximum residential property tax rate.